-

Articles + –

Soft drinks can fill the gap for alcohol alternatives in Brazil

According to a survey conducted by Brazil’s Ministry of Health, more than half of the Brazilian adult population is overweight. Consumers put the culprit on alcohol consumption, resulting in Brazilians drinking less alcohol.

According to Mintel research on alcoholic drinks consumption habits, two in five Brazilians who consume alcoholic drinks claim to be limiting their alcohol consumption as part of personal health management and the same number say they are spending less on alcoholic beverages. This suggests new opportunities for soft drink brands to consider targeting these health-conscious consumers with alcohol alternatives.

Explore alcohol alternatives through adult-like flavors in soft drinks

More sophisticated and adult-like flavors can allow carbonated soft drinks (CSDs) and other soft drinks to reach health-minded Brazilians who are looking for alcohol alternatives or who consider “natural” (eg no artificial colours/flavours and sweeteners) an important attribute when choosing a non-alcoholic blurred beverage.

In Europe, some CSD brands have acted on this opportunity by looking at ways to reformulate drinks to better suit as an alternative to alcoholic drinks or as a mixer for alcoholic drinks, providing wider consumption options. This has been widely achieved by developing more mature, less sweet and premium flavors.

In the US, two in five consumers drink regular carbonated soft drinks instead of alcohol. Brands that offer alcohol alternatives are expected to focus on delivering a variety of attributes including flavor, ingredients and packaging.

Explore more sophisticated flavors

Despite the fact that more than two in five Brazilian consumers claim to be reducing alcohol consumption, less than one in five alcoholic drink consumers are currently switching from alcoholic to non-alcoholic beverages. As such, producers need to find ways to increase their appeal.

Today, the choice for more interesting, sophisticated and adult-like soft drinks is limited. According to Mintel Global New Products Database (GNPD), new carbonated soft drink innovation in the last five years shows that traditional flavors dominate within new launches. Guarana, which is a well-established ingredient in CSDs in Latin America, is the top flavor, closely followed by cola, orange, lime and tonic.

LATAM soft drink launches with innovative flavours

A quarter of Brazilian CSD consumers would be encouraged to keep drinking/drink more CSDs if a larger variety of fruit flavours was available.

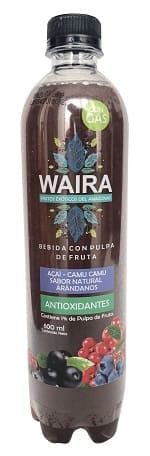

Açaí-Camu Camu: Waira Natural Blueberry Flavoured Açai-Camu Camu Carbonated Drink with Fruit Pulp contains 1% fruit pulp (Colombia).

Bergamot: Os Autênticos por Bevi Più Naturale Bergamot Soda with Calabrese Tangerine Juice is suitable for consuming with seafood, appetisers, fresh fruits and desserts, and has no artificial flavours, colourings or preservatives (Brazil).

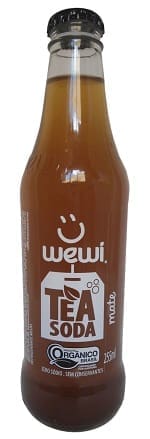

Yerba mate: Wewi Mate Tea Soda is an organic product that contains natural flavouring and is free from GMOs, gluten, preservatives and sodium (Brazil).

Explore less-sweet drink variants

Developing less-sweet soft drinks can be a viable strategy to follow in Brazil, considering that more than half of the Brazilian adult population is overweight and, as Mintel research shows, one-third of non-alcoholic beverages buyers tries to prevent gaining weight by limiting their drinking during meals.

European CSD examples that are developed to offer consumers less-sweet drink options can provide a source of inspiration for Brazilian soft drink brands. Less than two in five consumers in Brazil would be interested in trying more non-sweet beverage flavors (eg bitter, sour), with men driving the interest in such variants.

Clarity of positioning and product benefits are key to blurred non-alcoholic beverages

Non-alcoholic blurred beverages from various drinks categories hold strong opportunities in Brazil with nearly three in 10 consumers claiming they taste better than non-mixed beverages. However, one-third claim they are hard to find.

This suggests that blurred beverages have further development scope through stronger clarity of their positioning and benefits. This can be observed in the Bar Nøne range, which focuses not only on alcohol-free formulations, but also on the specific ingredients that provide a modern appeal and a healthier profile.

Blurred options can appeal to Brazilians who have opted for non-alcoholic beverages instead of alcohol. As taste remains an important purchasing factor, such drinks are expected to offer consumers more exciting flavor experiences.

What we think

Soft drink brands in Brazil have an opportunity to explore the positioning of their drinks as alcohol alternatives by developing more sophisticated, adult-like flavors, which also appeal to health-seeking adult consumers. This can also be a viable strategy to follow in order to appeal to health-minded consumers. Brands must invest in blurred non-alcoholic beverages that carry clear and strong marketing messages and also offer distinct benefits.

Regina is a Global Food & Drink Analyst. As part of the analyst team she provides insights on product innovation, trends and packaging and market developments globally.

-

Market research on behaviors towards carbonated soft drinks: 2021Discover the carbonated soft drink market in Brazil...Explore this Research

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo